Business

Tips and Advice to Invest in Citizenship by Investment Programmes (CIP)

Citizenship Investment Programs (or CIPs) offer residency and citizenship options to individuals who invest in specific areas. Successful applicants of these programmes get the benefits of investing in their country by buying property, starting a business, or setting up a trust. These programmes also allow investors to take advantage of non-resident privileges, including owning property, investing in companies, and making other commercial deals in the country. In this blog post, we’ll discuss some insights about Citizenship by Investment (CBI) programmes and how you can participate in one. Outside of the United States, CbIs are not common so you may be unfamiliar with them.

However, they are very popular in countries such as Canada and Australia, providing an abundance of residency programs to foreign nationals who want to live there.

What is Citizenship by Investment

Be careful about personal Loan in UAE 2000 salary, it may make you Unhappy

Citizenship by investment programmes allows foreign nationals to invest in the country’s economy by acquiring residency or citizenship for themselves and their family members. The host country’s government will provide investors with more favorable tax and immigration laws than foreign citizens. Therefore, if you have a certain amount of money to invest, you can get residency and/or citizenship through a CIP programme. Citizenship by investment is a type of immigration programme under which citizens or permanent residents of one country can become citizens of another country by investing in it. A foreign national can apply for citizenship by investment if he/she has a certain amount of money to invest. With this form of immigration, a person can get the right of living in another country and may also be eligible for direct citizenship.

Benefits of Citizenship by Investment Programmes

– Permanent Residency – Permanent residency allows you to live and work in another country without needing a visa or work permit. You can also easily apply for citizenship if you have the required amount of money. The permanent residency also allows you to open a bank account and participate in business activities per local laws.

– Reduced Capital Gains – Invested money will be considered a personal asset and will not be taxed as business profits. Therefore, you will only be taxed on the interest earned from your investment.

– Child Born in the Country – Children born in the country during the residency will be considered citizens at birth. They will have all the privileges of citizenship including voting, getting employment, and going abroad.

– No Long Waiting Period – No specific waiting period for residency as per Citizenship and Immigration Canada (CIC). Your residency period will depend on how much you have invested.

– Investment Based On Your Ability – You can invest a maximum of $50,000 or 5% of your total net worth as per Citizenship and Immigration Canada (CIC).

Tips and advice for investing in a CIP

– Research the Programme – Before participating in any investment programme, you should do thorough research on the programme. Visit the website of the government of the country where you want to invest, research their policies and legislation, and understand their requirements. You also have to understand your rights and responsibilities per the host country’s laws.

– Understand the Return on Investment – Due to the increase in the number of people investing in citizenship by investment programmes, there have been reports that many of these programmes offer extremely low rates of return. Therefore, you should be careful when choosing a CIP programme.

– Know Your Limits – When you invest in a CIP programme, you must meet certain financial requirements. Therefore, you should not invest more than what you can afford to lose.

– Do Not Wait for the Perfect Opportunity – Unlike equity-based investment, CIP programmes are unsuitable for investments with low rates of return. Therefore, you should not wait for a perfect opportunity to invest in a CIP programme. You can also consider investing in a CIP programme if you come across any opportunities like a government service visa, lottery, estate or inheritance, and gift cards.

– Understand the Terms and Conditions – It is essential to understand the terms and conditions of a CIP programme before investing in it. You should also understand the role of the attorney, the trustee, and the sponsor.

Types of CIPs

There are many types of citizenship-by-investment programmes:

– Investment-Based: This programme is based on the principle of making an investment and receiving residency or citizenship in return. Some examples of this are the Saudi Arabian Ar Riyal Program and the Barbados Citizenship-by-Investment Programme.

– Residency-Based: Under this type of programme, you are offered a residency in return for an investment. You can also apply for citizenship after a fixed period. Some examples of this are the UK Visit visa and the Norwegian Investment Visa. – Direct: This type of programme is a direct grant of citizenship to the applicant. The investment required under this type of programme is much lower than in other types. Some examples of this are the UK all-British programme and the Indian Citizenship by Investment Programme. – Hybrid: This type of programme combines two or more of the above-mentioned types of programmes. Some examples of this are the Hungarian Investment-Based Dual Citizenship and the Australian dual citizenship by investment scheme.

Requirements for Citizenship by Investment Programme

– Minimum investment – Most citizenship-by-investment programmes require you to invest a certain amount of money. However, some programs allow you to invest as low as $5,000. You should not invest money that you cannot afford to lose.

– Adequate source of funds – All the citizenship-by-investment programmes require you to invest legally obtained funds. You can’t invest in any form of financial crime or illegal activities.

– Length of time – All the citizenship-by-investment programmes require you to invest for a specified period.

Conclusion

Citizenship by investment programmes is a great way to get a residency and/or citizenship in your country. They allow you to invest in a government programmes, and in exchange, you get a residency and/or citizenship from your government. This type of immigration is a great way to immigrate to a new country and it is often much easier to obtain than a permanent residency visa.

Business

Amazon Courtesy Credit: Understanding and Utilizing It

Amazon courtesy credit, the e-commerce giant, is known for its customer-centric approach and commitment to ensuring a satisfactory shopping experience for its users. One of the ways Amazon achieves this is through its CC policy, aimed at compensating customers for certain inconveniences or issues encountered during their shopping journey.

What is Amazon Courtesy Credit?

Amazon Courtesy Credit (ACC) is a form of compensation provided to customers in recognition of various issues or inconveniences they may experience while shopping on the platform. It serves as a gesture of goodwill from Amazon to maintain customer satisfaction and loyalty.

Instances Eligible for Amazon Courtesy Credit

Late Deliveries

Customers may be eligible for ACC if their orders are delivered later than the estimated delivery date provided at the time of purchase.

Damaged or Defective Items

In cases where items arrive damaged or defective, customers can request ACC as a form of compensation for the inconvenience caused.

Inaccurate Product Descriptions

If customers receive items that do not match the product descriptions or specifications listed on the this website, they may qualify for ACC.

How to Request Amazon Courtesy Credit

Customers can request ACC by contacting Amazon customer support and providing details about the issue they encountered. Amazon representatives will assess the situation and determine if compensation is warranted.

Factors Affecting Amazon Courtesy Credit

Customer History and Engagement

Amazon may take into account a customer’s purchase history, order frequency, and overall engagement with the platform when determining eligibility for ACC.

Order Frequency

Frequent and loyal Amazon customers may receive more favorable consideration for courtesy credit compared to occasional shoppers.

Issue Severity

The severity and impact of the issue experienced by the customer also play a role in determining the amount of CC provided.

Benefits of Amazon Courtesy Credit

Amazon Courtesy Credit offers several benefits to customers, including:

- Compensation for inconvenience or dissatisfaction with the shopping experience.

- Enhanced customer satisfaction and loyalty.

- Reinforcement of Amazon’s commitment to customer service excellence.

Limitations and Considerations

While Amazon Courtesy Credit can help address certain issues encountered by customers, it’s important to note that it may not fully compensate for all inconveniences or dissatisfaction experienced during the shopping process.

Customer Experiences and Feedback

Many Amazon customers have shared their experiences and feedback regarding Amazon Courtesy Credit on various online platforms and forums. Exploring these insights can provide valuable perspectives and tips for navigating the process of requesting and utilizing courtesy credit.

Conclusion

It serves as a valuable tool for maintaining customer satisfaction and loyalty by compensating users for certain issues or inconveniences encountered during their shopping experience. By understanding the eligibility criteria and process for requesting courtesy credit, customers can leverage this benefit to enhance their overall shopping experience on Amazon.

FAQs

How do I request ACC for a late delivery?

- To request it for a late delivery, you can contact Amazon customer support through their website or app. Provide details about your order, including the order number and the estimated delivery date. Amazon representatives will assess the situation and may offer compensation in the form of CC.

What should I do if I receive a damaged or defective item from Amazon?

- If you receive a damaged or defective item from Amazon, you should contact Amazon customer support immediately to report the issue. Provide relevant details such as the order number, item description, and images showing the damage or defect. Amazon will assist you in resolving the issue and may offer CC as compensation.

Is ACC provided automatically, or do I need to request it?

- ACC is not provided automatically. You need to request it by contacting Amazon customer support and explaining the issue you encountered. Amazon representatives will evaluate your request and determine if CC is warranted based on their policies and guidelines.

Can I use ACC for future purchases on the platform?

- Yes, ACC can typically be used for future purchases on the Amazon platform. Once credited to your account, CC can be applied towards the payment of eligible items during checkout. However, it’s essential to check the terms and conditions associated with the Courtesy Credit for any specific limitations or restrictions.

Are there any restrictions or limitations on the use of ACC?

- While It can generally be used for purchases on the platform, there may be certain restrictions or limitations depending on the terms and conditions associated with the credit. For example, Courtesy Credit may have an expiration date or be limited to specific categories of products. It’s advisable to review the terms carefully to understand any restrictions before using the Courtesy Credit.

Business

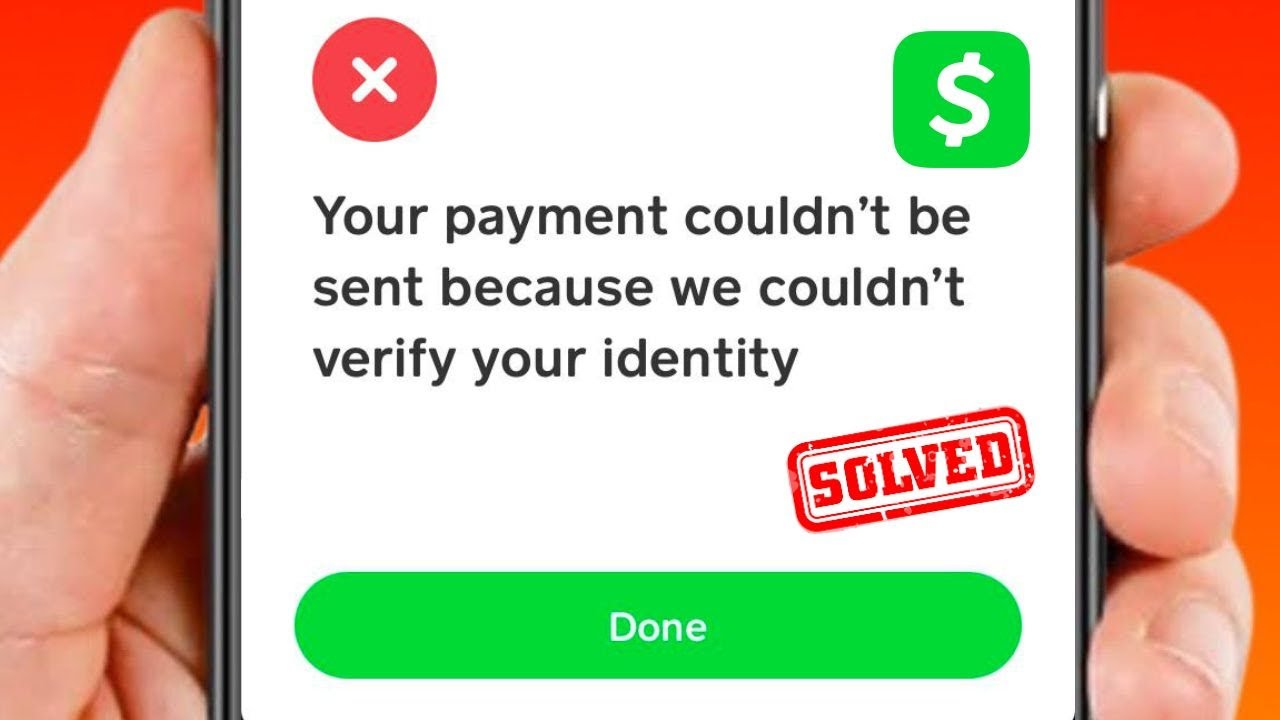

Your Payment Could Not Be Sent on Cash App: Understanding and Resolving Issues

The article “your payment could not be sent cash app” This app emerged as one of the leading mobile payment platforms, offering users a convenient way to send, receive, and manage money directly from their smartphones. While Cash App provides a seamless payment experience for millions of users, occasional issues may arise, leading to payment failures and frustrations for users.

Understanding Payment Issues on Cash App

Payment issues on Cash App can occur due to various reasons, ranging from technical glitches to user error. When your payment cannot be sent on Cash App, it’s essential to understand the underlying causes and take appropriate steps to resolve the issue promptly.

Common Reasons for Payment Failures

Several factors can contribute to payment failures on Cash App, including insufficient funds, incorrect recipient information, network connectivity issues, and security concerns. Identifying the specific reason for the payment failure is crucial for resolving the issue effectively.

Steps to Take When Your Payment Cannot be Sent

If your payment could not be sent on Cash App, consider the following steps to troubleshoot the issue:

Check Account Balance:

- Ensure that you have sufficient funds in your Cash App account to cover the payment amount.

Verify Recipient Information:

- Double-check the recipient’s details, including their Cash App username or phone number, to ensure accuracy.

Retry the Payment:

- Attempt to resend the payment after confirming that all details are correct.

Monitor Transaction Status:

- Keep track of the transaction status within the Cash App interface to receive real-time updates on the payment attempt.

Contact Cash App Support:

- If the issue persists, reach out to Cash App support for assistance and further troubleshooting steps.

Contacting Cash App Support

In case of persistent payment issues, contacting Cash App support is the best course of action. Users can reach out to Cash App customer service through the app or website for personalized assistance and resolution of payment-related concerns.

Tips to Avoid Payment Issues on Cash App

To minimize the risk of payment failures and ensure a smooth transaction experience on Cash App, consider the following tips:

- Maintain Sufficient Funds: Regularly check your Cash App balance and add funds as needed to avoid payment failures due to insufficient funds.

- Verify Recipient Details: Always double-check the recipient’s information before initiating a payment to prevent errors and potential delays.

- Stay Updated: Keep your Cash App and device software up to date to benefit from the latest security patches and enhancements.

- Use Secure Networks: Avoid conducting Cash App transactions over unsecured or public Wi-Fi networks to protect your sensitive information from potential security threats.

Ensuring Account Security

In addition to addressing payment issues, prioritizing account security is paramount when using Cash App. Users should enable two-factor authentication, review transaction history regularly, and report any unauthorized activity promptly to safeguard their accounts and financial information.

Comparing Cash App with Other Payment Platforms

While Cash App offers convenience and flexibility for peer-to-peer payments, it’s essential to compare its features and functionality with other payment platforms. By evaluating factors such as transaction fees, security measures, and user experience, users can make informed decisions about which platform best suits their needs.

Conclusion

In conclusion, encountering payment issues on Cash App can be frustrating, but understanding the underlying causes and taking proactive steps can help resolve the problem effectively. By following best practices for account security, verifying recipient information, and staying informed about transaction status, users can minimize the risk of payment failures and enjoy a seamless payment experience on Cash App.

FAQs

What should I do if my payment fails on Cash App?

- If your payment fails on Cash App, double-check the recipient’s information and account balance before attempting to resend the payment. If the issue persists, contact Cash App support for assistance.

How long does it take for Cash App to resolve payment issues?

- The time taken to resolve payment issues on Cash App varies depending on the nature of the problem. In most cases, Cash App strives to address payment concerns promptly and efficiently.

Can I cancel a failed payment on Cash App?

- Yes, users have the option to cancel a failed payment on Cash App before it is successfully processed. However, once a payment is completed, it cannot be canceled or reversed.

Does Cash App charge a fee for failed payments?

- Cash App does not charge a fee for failed payments. However, standard transaction fees may apply when sending money or using certain features within the app.

Are there any limits on the amount of money I can send through Cash App?

- Cash App imposes certain limits on the amount of money users can send and receive within a specified time frame. These limits may vary based on account verification status and other factors.

Business

Ace Hair Extensions & Co Overtakes other beauty brands with it’s new Serum & XL Ace Lace Glue

A brand receiving strong demands for its services must always continue to listen to their customers on what better ways to serve them, which Ace Hair Extensions & Co did last year which led to the innovations of new skus and items.

They have continued to defie luxury downturn and have continued to see new customer satisfactory reviews on forums and social media blogs alike.

Besides their Glue being #1 on the market for bonding strength, The Parfum Serum is made with different plant and root extracts, revealing natural scents and tones that last all day.

It’s Non oily, very silk-like, smells amazing, and is made from organic properties.

Many owning these beautiful products know how much they mean to Ace Hair Extensions & Co when they receive their packages in the mail and see the stylish packaging and attention to detail so they dress their bathroom counters and dressing tables up with their new luxuries.

Experience greatness again https://acehairextensionsco.com/products/hair-serum?variant=40613161369661

Others10 months ago

Others10 months agoDavid T Bolno: Why Giving Back To The Community Is So Crucial

Travel10 months ago

Travel10 months agoPractical And Essential Car Interior Accessories To Add Comfort And Convenience To Your Drive

Travel10 months ago

Travel10 months agoBusiness Visa for CANADA

Business10 months ago

Business10 months agoTop Reasons Why you Need to Consider Outsourcing Real Estate Photo Editing

Health10 months ago

Health10 months agoGarlic Is The Best Vegetable To Treat Heart Problems

Fashion10 months ago

Fashion10 months agoTips For Choosing The Right For Engagement Diamond Rings

Business10 months ago

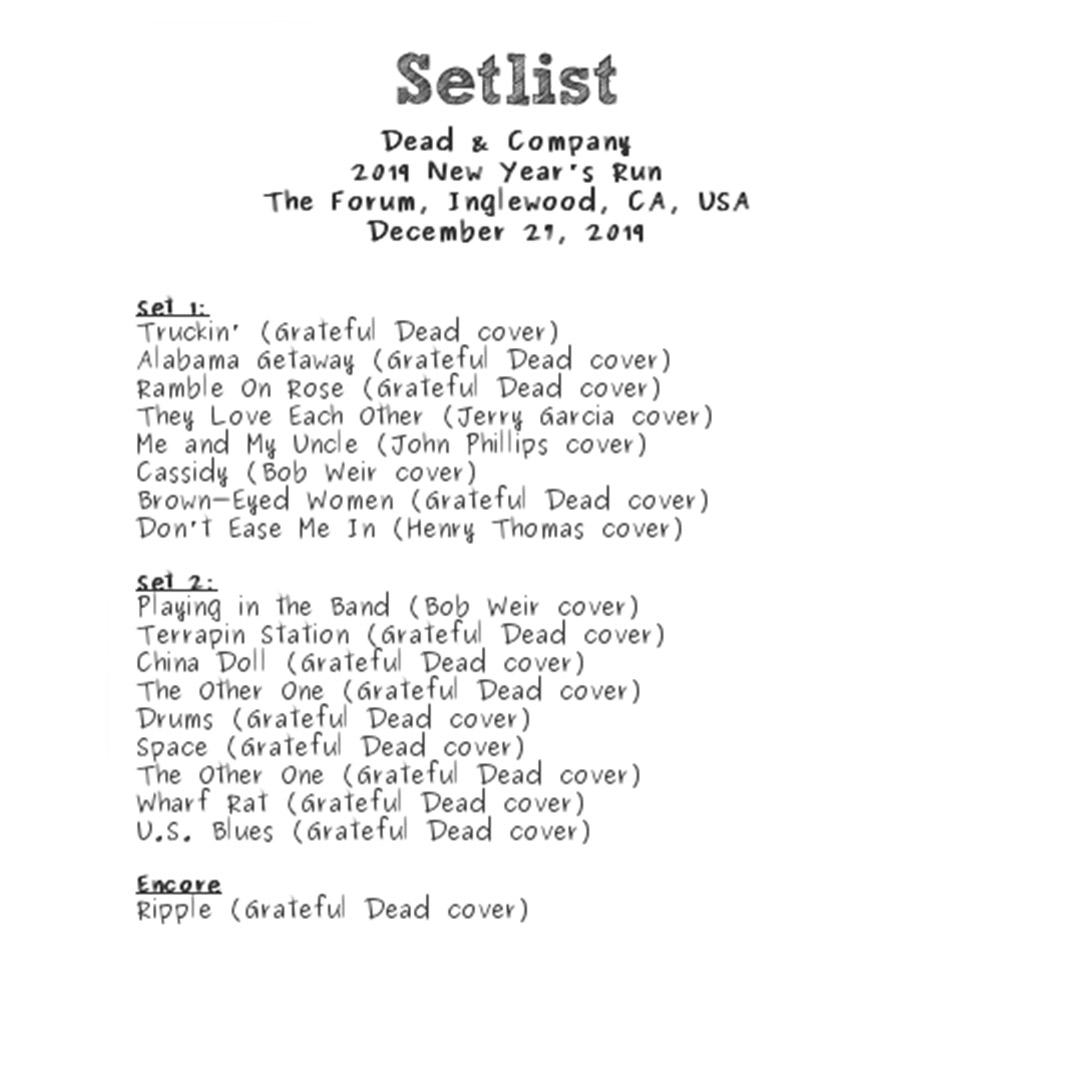

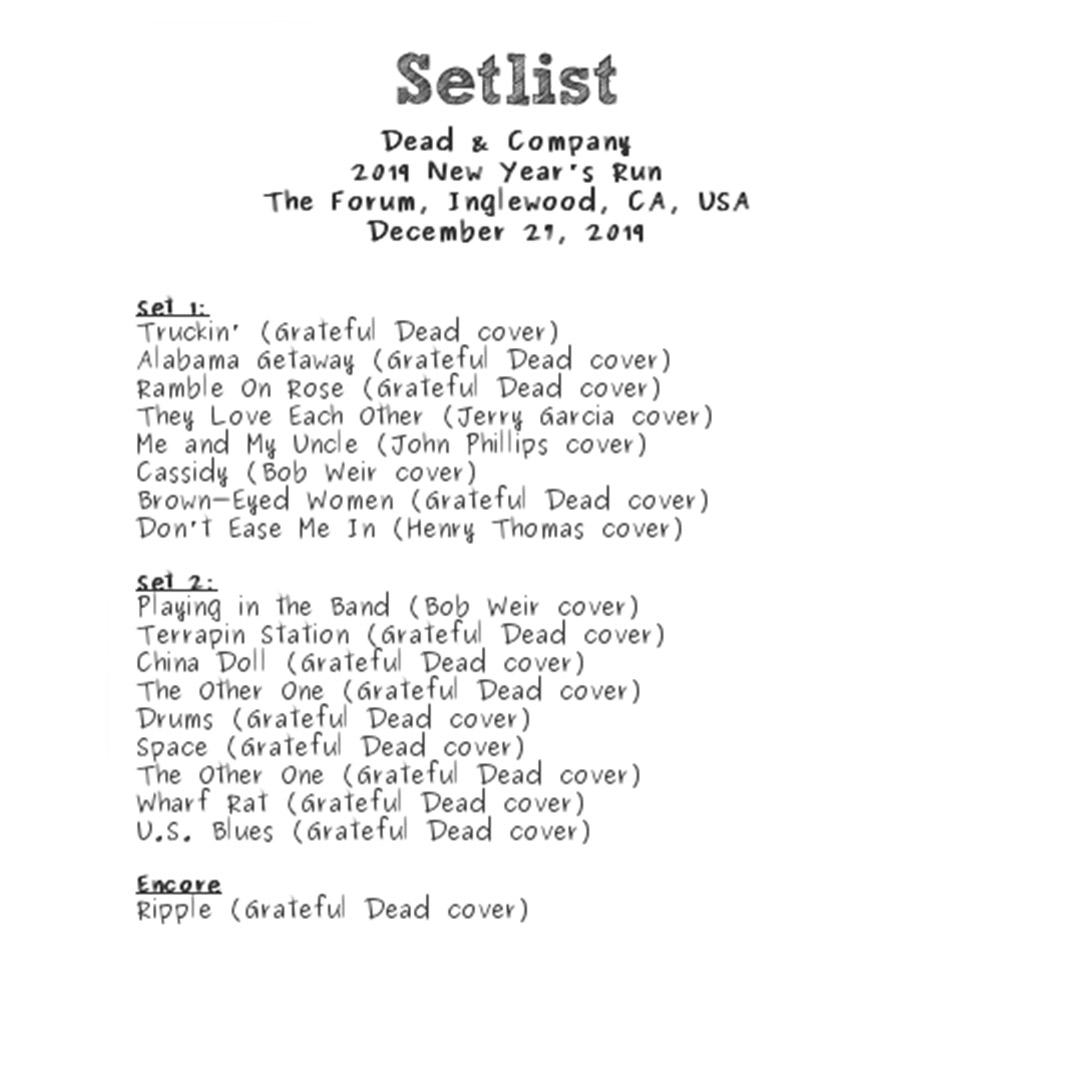

Business10 months agoDead And Co Setlist What They Played At The Gorge Amphitheatre

Tech10 months ago

Tech10 months agoThe Best Way to Never Get Lost: Buy Wayfinding Signs!